Cyber Insurance

Cyber threats are no longer limited to large corporations. Small and medium-sized businesses are often targeted because of weaker security systems and valuable customer data. A single incident — whether a phishing scam, ransomware attack, or accidental data leak — can cost millions in recovery, fines, and lost trust.

Cyber Insurance safeguards your business against these growing risks by covering expenses related to data breaches, system restoration, and crisis management. At Expat Insurance Hong Kong, we help you secure policies that provide complete protection — from immediate response to long-term recovery support.

Why Work With Expat Insurance?

Expert Guidance. Fast Protection.

Choosing the right Cyber Insurance policy requires understanding your technology, data flows, and potential vulnerabilities.

We learn About Your Business.

We evaluate your computer systems, data storage, third-party integrations etc.

We clarify your protection options.

We explain the difference between first-party (your losses) and third-party (client claims) coverage.

We negotiate better terms.

We ensure your policy includes incident response support, low deductibles, and broad coverage.

Why Choose Cyber Insurance?

Cyber threats are not limited to large corporations. Small and medium-sized businesses are often targeted due to weaker security systems and valuable customer data. A single incident — whether a phishing scam, ransomware attack, or accidental data leak — can cost millions in recovery, fines, and lost trust. Businesses rely on digital systems to operate — from client databases to online payments and communications, but with connectivity comes exposure. Cyber Insurance provides your company with financial backup, expert response, and the resources to recover fast.

What Does Cyber Insurance Include?

Data Breach Response – covers investigation, notification, and recovery costs after a cyberattack

Ransomware & Extortion – financial protection if hackers demand payment or disable your systems

Network Security Liability – defense against third-party claims for compromised data or service outages

Business Interruption – compensation for lost income due to cyber incidents or downtime

Reputation Management – covers PR and communication efforts to restore public trust

Regulatory Fines & Legal Fees – assistance with penalties, investigations, and settlements

Possible Pitfalls We Help You Avoid

-

Data breach exclusions: Many basic policies exclude cyber events. We ensure your plan covers digital and physical data breaches.

-

Limited ransomware coverage: Some insurers cap payouts for extortion. We make sure your ransomware protection is sufficient and comprehensive.

-

Missed business interruption protection: Not all policies include income loss coverage.

-

Vendor-related breaches: When third-party systems cause a data loss, coverage can fail. We help include extended liability protection across your supply chain.

With Expat Insurance, your business gains more than a policy — you gain a strategic partner dedicated to keeping your operations, data, and reputation safe from today’s most advanced threats.

Need Help? Contact Us Today.

We Ensure Professional Insurance Services

Need Other Insurance Products?

Medical Insurance

Comprehensive coverage for individuals and families — from hospital and surgical care to maternity and critical illness protection.

Corporate / Group

Flexible group plans can help promote well-being for long-term business success, and increased staff retention for your business.

Business Insurance

Protects your company from property damage, liability, and income loss — ensuring long-term stability and business resilience.

Property Insurance

Safeguards your home and lifestyle from fire, theft, or accidental damage, keeping your property secure for your peace of mind secure.

Life Insurance

Provides financial security and peace of mind for your family, helping them stay stable and avoid added stress if the unexpected occurs.

Our Simple Process

Talk to us about your needs

We learn your budget, lifestyle, and health priorities.

Compare your best options

We present suitable plans side-by-side in clear language.

Get you insured quickly

We handle the applications, forms, and negotiations.

Stay with you long-term

Each year, we review your policy and help with claims.

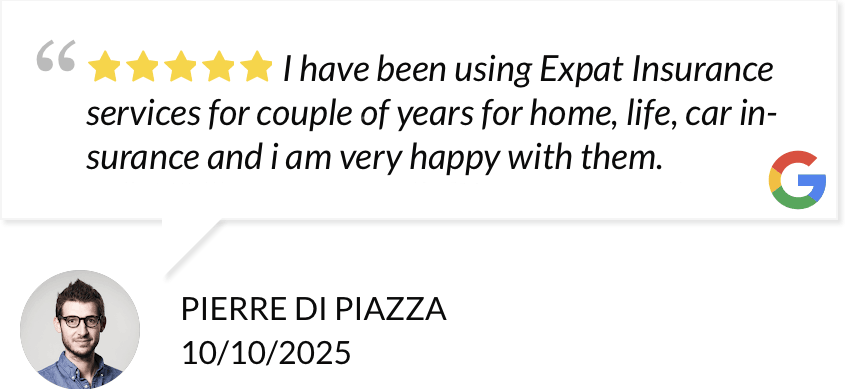

testimonials

Why Our Clients Are Satisfied

Our service consistently exceeds expectations. But don’t just take our word for it—here’s what our customers have to say!

Real Stories That Show the Difference

An airline executive broke his ankle and faced a HKD 270,000 hospital bill. His company scheme only covered half. A broker-arranged plan filled the gap, saving him HKD 120,000.

A young expat couple secured comprehensive cover before starting a family. When faced with complications, their policy saved them from six-figure maternity costs.

An American professional developed cancer just months after taking out coverage. Because he had comprehensive, worldwide cover, he was able to choose treatment both in the US and Hong Kong.

Commonplace in Hong Kong, these events show how one illness or accident can rapidly become a financial emergency. The outcome often depends on whether the right policy is in place.

Protect What Matters With Confidence

Don’t wait until an emergency strikes to realise your coverage isn’t enough. With expert guidance from Expat Insurance, you can be certain that your health, home, and future are fully protected.

Blog & News Update

How I Negotiated Zero Premium Increase for a Client with an Ageing Workforce

Last quarter, I sat across from an insurer who wanted to raise premiums by 8%…

Avoiding the Problem of Group Insurance Gaps

I've watched HR teams discover their group insurance gaps in real time.An employee needs surgery.…

Why Drone Insurance Breaks Every Aviation Rule

Traditional aviation insurance makes one fundamental assumption: the pilot can see what they're flying.Direct line…