Whole Life Insurance

Unlike short-term protection, Whole Life Insurance stays with you for life. It not only provides a guaranteed payout upon death or permanent disability, but also builds cash value over time — a financial reserve you can access when needed for education, emergencies, or retirement planning.

For expats in Hong Kong, this means you can protect your loved ones while creating a stable, low-risk savings plan that grows steadily in the background, regardless of market fluctuations. Over time, your policy can become a meaningful asset — offering both lifelong coverage and a foundation for intergenerational wealth. At Expat Insurance Hong Kong, we help you choose policies that balance protection, growth, and flexibility — so you can plan confidently for your family’s future, wherever life may lead.

Why Work With Expat Insurance?

Balanced Protection. Honest Advice. Tailored Plans.

Choosing the right Whole Life policy involves understanding how protection and investment interact. We make that simple.

We assess your goals.

We evaluate your financial objectives, risk tolerance, and family commitments.

We clarify policy options.

We explain cash value growth, dividend structures, and withdrawal flexibility in plain terms.

We compare insurers.

We source the most competitive plans from leading global and local providers.

We manage long-term support.

We review your policy annually to ensure it continues meeting your evolving needs.

Why Choose Whole Life Insurance?

Whole Life Insurance is ideal if you want lasting protection that also acts as a conservative investment. With a portion of your premiums allocated to savings, your policy accumulates value each year. This can later be withdrawn or borrowed against, giving you access to funds for education, emergencies, or retirement.

What Does Whole Life Insurance Include?

Lifetime Coverage – guaranteed protection for as long as you live

Death & Disability Benefits – lump-sum payout to your beneficiaries

Cash Value Growth – savings that increase through participating funds

Dividend Options – earn bonuses based on fund performance

Partial Withdrawals – flexibility to access your money when needed

Critical Illness Add-ons – optional coverage for serious conditions

Global Protection – valid coverage no matter where you live or work

Possible Pitfalls We Help You Avoid

Low growth assumptions: We make sure your projected returns are realistic, not overstated.

Overlapping coverage: We review existing life policies to avoid duplication and wasted premiums.

Liquidity issues: Some plans lock funds too long. We select flexible options with partial access when you need it.

Complex fine print: We simplify policy language so you fully understand how your benefits work.

Lack of estate planning integration: Some policies aren’t aligned with long-term inheritance goals. We coordinate your coverage with your wider financial and estate plans for lasting security.

At Expat Insurance, we help you create a lifelong financial plan that provides more than protection — it builds value, supports your goals, and secures your family’s future with clarity and confidence.

Need Help? Contact Us Today.

We Ensure Professional Insurance Services

Need Other Insurance Products?

Medical Insurance

Comprehensive coverage for individuals and families — from hospital and surgical care to maternity and critical illness protection.

Corporate / Group

Flexible group plans can help promote well-being for long-term business success, and increased staff retention for your business.

Business Insurance

Protects your company from property damage, liability, and income loss — ensuring long-term stability and business resilience.

Property Insurance

Safeguards your home and lifestyle from fire, theft, or accidental damage, keeping your property secure for your peace of mind secure.

Life Insurance

Provides financial security and peace of mind for your family, helping them stay stable and avoid added stress if the unexpected occurs.

Our Simple Process

Talk to us about your needs

We learn your budget, lifestyle, and health priorities.

Compare your best options

We present suitable plans side-by-side in clear language.

Get you insured quickly

We handle the applications, forms, and negotiations.

Stay with you long-term

Each year, we review your policy and help with claims.

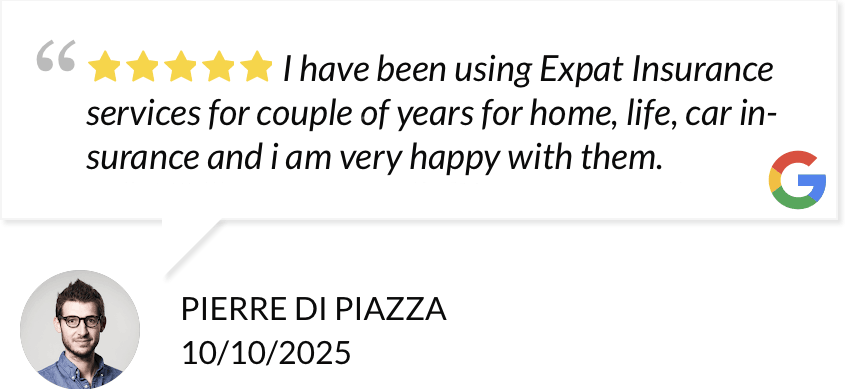

testimonials

Why Our Clients Are Satisfied

Our service consistently exceeds expectations. But don’t just take our word for it—here’s what our customers have to say!

Real Stories That Show the Difference

An airline executive broke his ankle and faced a HKD 270,000 hospital bill. His company scheme only covered half. A broker-arranged plan filled the gap, saving him HKD 120,000.

A young expat couple secured comprehensive cover before starting a family. When faced with complications, their policy saved them from six-figure maternity costs.

An American professional developed cancer just months after taking out coverage. Because he had comprehensive, worldwide cover, he was able to choose treatment both in the US and Hong Kong.

These aren’t unusual events — they happen every day in Hong Kong, where one hospital stay, accident, or sudden illness can quickly become a financial burden. The difference between being protected and exposed often comes down to a single factor: having the right insurance policy.

Protect What Matters With Confidence

Don’t wait until an emergency strikes to realise your coverage isn’t enough. With expert guidance from Expat Insurance, you can be certain that your health, home, and future are fully protected.

Blog & News Update

How I Negotiated Zero Premium Increase for a Client with an Ageing Workforce

Last quarter, I sat across from an insurer who wanted to raise premiums by 8%…

Avoiding the Problem of Group Insurance Gaps

I've watched HR teams discover their group insurance gaps in real time.An employee needs surgery.…

Why Drone Insurance Breaks Every Aviation Rule

Traditional aviation insurance makes one fundamental assumption: the pilot can see what they're flying.Direct line…